The construction industry, after the judgment of the CJEU in the case of Budimex, heaved a sigh of relief

The industry is still moved by the ground-breaking judgment of the Court of Justice of the European Union issued in the case of Budimex S.A. We would like to remind you that in the GWW team running the case was led by Małgorzata Militz, attorney-at-law, partner.

The judgment defined the moment when it can be assumed that a construction service or construction and assembly service was performed for the VAT purposes. The decision of the Court was considered as extremely important both in the trade press and journalistic press (Forbes, bezprawnik.pl), and was also appreciated by the largest law offices dealing with tax consulting in the country.

We invite you to read the article on this key judgment for the construction industry: https://www.forbes.pl/opinie/kiedy-usluge-budowlana-mozna-uznac-za-wykonana-decyzja-trybunalu-w-luksemburgu/qrjgne9

Photo: Forbes.pl

Related posts

Reduced working hours – pilot programme

Reduced working hours – pilot programme New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?Promotions to senior associate in the legal team at GWW

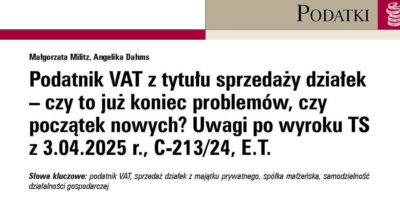

Promotions to senior associate in the legal team at GWWIs the sale of private plots always considered economic activity subject to VAT? Article.

Is the sale of private plots always considered economic activity subject to VAT? Article.Concerned about

missing out

on key legal

developments?