White list of taxpayers, split payment etc., i.e. changes in taxes are coming

In the forthcoming months, we will face a number of changes in the field of VAT. First of them will come into force on September 1 this year. What are these changes and how will they affect taxpayers? The upcoming changes, including the so-called White list of taxpayers, split payment and JPK_VDEK, are commented by Zdzisław Modzelewski, tax advisor, partner of GWW Tax in an interview Robert Bohdanowicz in the material of Dziennik Gazeta Prawna daily.

Link to the recording: https://podatki.gazetaprawna.pl/artykuly/1426013,biala-lista-podatnikow-split-payment-zmiany-podatki.html

Related posts

Reduced working hours – pilot programme

Reduced working hours – pilot programme New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?Promotions to senior associate in the legal team at GWW

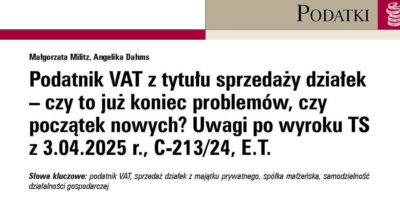

Promotions to senior associate in the legal team at GWWIs the sale of private plots always considered economic activity subject to VAT? Article.

Is the sale of private plots always considered economic activity subject to VAT? Article.Concerned about

missing out

on key legal

developments?