Free remission of shares – courts uphold, tax authorities uphold

The tax authorities consider free-of-charge voluntary redemption of shares in companies to be a controlled transaction and impose on taxpayers obligations under transfer pricing regulations. A different view is expressed in the judicature. The article by Radosław Chudy was published in "Rzeczpospolita" – we encourage you to read it.

Related posts

Reduced working hours – pilot programme

Reduced working hours – pilot programme New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

news New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?

New explanations from the Ministry of Finance on the beneficial owner clause – what changes in WHT?Promotions to senior associate in the legal team at GWW

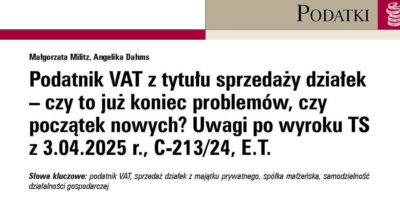

Promotions to senior associate in the legal team at GWWIs the sale of private plots always considered economic activity subject to VAT? Article.

Is the sale of private plots always considered economic activity subject to VAT? Article.Concerned about

missing out

on key legal

developments?